- Pulse by Capital Stake

- Posts

- Stocks 📉 Shocks ⚡ Shifts 🔀

Stocks 📉 Shocks ⚡ Shifts 🔀

Another Week, Another Pulse!

This week had no shortage of drama—from political tension to market turbulence. Speculation of a potential military threat from India within the next 24 to 36 hours rattled investors and caused sharp declines in the stock market. At the same time, geopolitical tensions escalated as India raised concerns with the IMF over its loans to Pakistan—just as the IMF is set to meet on May 9 to review a crucial $1.3 billion bailout for Pakistan. In the energy sector, a group of major oil-producing countries, known as OPEC+, announced plans to increase oil production in June, which could lead to even cheaper petrol prices (See Trend📊). Meanwhile, gold prices in Pakistan followed global trends and saw a dip. And all eyes are now on the upcoming monetary policy announcement the second last announcement for FY25 on Monday, with many expecting a major interest rate cut—possibly bringing it down to 11% (📊See Chart). Amidst this, Warren Buffett shocked the business world by announcing he will step down as CEO of Berkshire Hathaway, passing leadership to Greg Abel.

Here’s your 5-minute round-up of all the key events shaking up business, finance, and tech.

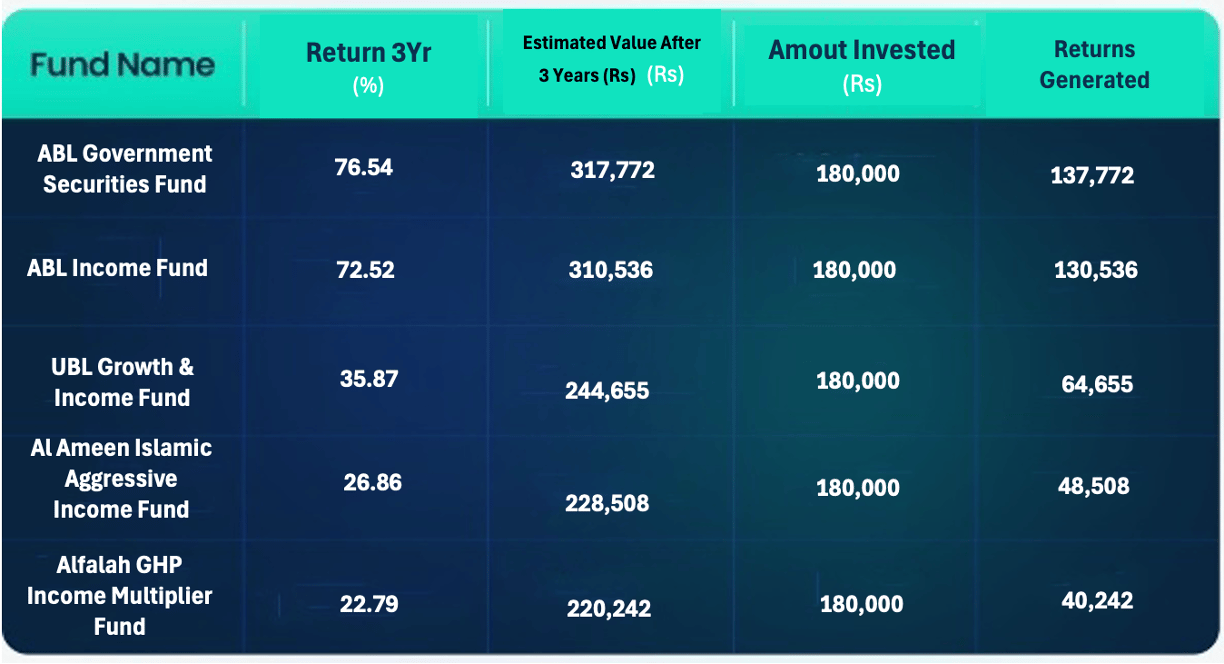

The Power of Consistent Investing: How Your SIPs Can Grow Over Time

If you had invested Rs 5,000 every month in some of the top income funds in Pakistan over the past 3 years, here’s how your investment could have grown, based on the highest returns of income funds in the last 3 years:

Credits: Behtari

Source: MUFAP

By investing Rs 5,000 every month, your total investment over 3 years would have amounted to Rs 180,000.

Based on the highest returns from these income funds in the last 3 years, you could have seen your investment grow to anywhere from Rs 220,242 to Rs 317,772, generating returns ranging from Rs 40,242 to Rs 137,772.

Systematic Investment Plan (SIP) can help you accumulate wealth over time with consistent contributions. But that's not all—we at Behtari are making our SIPs/Monthly Plans even better! Stay tuned for exciting updates that will make your investment experience even more rewarding.

Ready to get started?

Download the Behtari app now and start investing smartly. Stay updated on our improvements and enjoy a better way to manage your investments.

Download Behtari App Now📱 : |

📅 Key Events to Watch this Week!

📌 May 5, 2025

📈 Cement Sales Data

🏦 SBP Monetary Policy Announcement

🌲 Start of UN Forum on Forests (May 5–9)

📌 May 6, 2025

🤖 ECOSOC Special Meeting on Artificial Intelligence

📌 May 8, 2025

💱 Foreign Exchange Reserves Update

📌 May 9, 2025

🛒 Weekly SPI (Sensitive Price Index)

💻 Start of ITCN Asia (May 9–11)

📌 Earlier This Year

♿ Global Disability Summit (April 2–3, 2025)

Note: These dates are tentative and subject to change. Credits: Pulse by Capital Stake

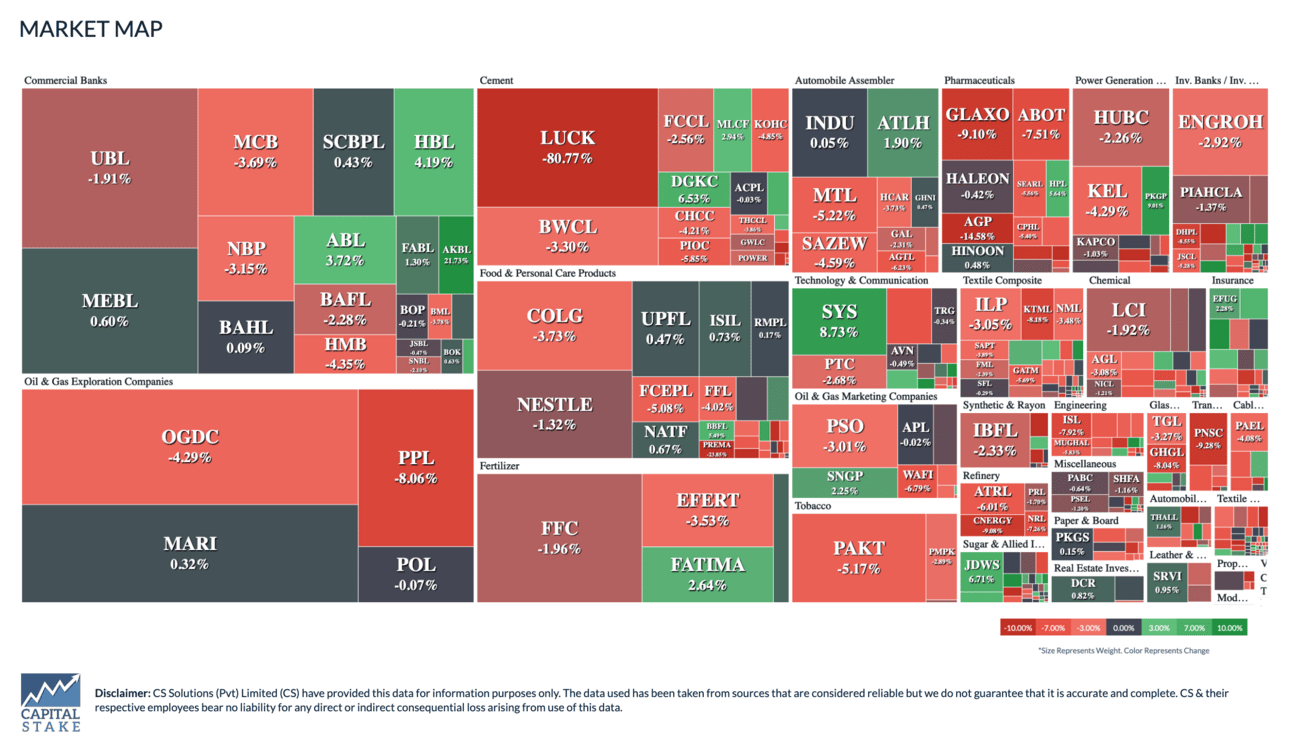

Market Overview: Week at PSX

The KSE 100 index navigated a turbulent week, reflecting the broader political uncertainty, and closed 1.17% lower compared to the previous week. Despite the volatility, market sentiment showed signs of recovery following reports of de-escalation in the India-Pakistan tensions, which helped restore some investor confidence.

DigiEstate Applies for Listing At PSX

DigiEstate, Pakistan's first Shariah-compliant fintech/proptech startup, has applied to list its Real Estate Security Tokens (REST) on the Pakistan Stock Exchange (PSX). Tokenizing refers to converting real estate into digital tokens on a blockchain, making ownership tradable and more accessible. This move aims to make real estate more accessible by tokenizing property ownership, allowing easy trading without physical transactions. It’s a significant step toward the adoption of digital assets in Pakistan, attracting investment, particularly from overseas Pakistanis. This could pave the way for broader digital investment in the country’s financial market.

Pakistan’s remittances surge 37% YoY in March, cross $4bn mark for first time

Pakistan's remittances reached a record $4.1 billion in March 2025, a 37% increase year-over-year (See Trend📊), marking the first time they’ve crossed the $4 billion mark. Monthly remittances were up 30% compared to February 2025. For the July-March period of FY25, remittances totaled $28 billion, a 33.2% increase from the previous year. This surge is crucial for Pakistan’s economy, providing essential foreign exchange and helping stabilize the financial outlook. The inflow of remittances is expected to ease pressure on the Pakistani Rupee (PKR), improve foreign exchange reserves, and reduce reliance on external debt. Continued growth in remittances could further strengthen the dollar situation, support economic stability, and contribute to a more stable exchange rate.

Pakistan's Inflation Hits 6-Decade Low, But Price Hikes on Essentials Spark Concern

Pakistan's inflation rate dropped to a six-decade low of just 0.3% in April, surprising many experts who expected an increase. This is the lowest inflation rate since 1965 (See historical data📊), making it a significant shift in the economy. However, there was a slight rise in weekly inflation by 0.15% (See trend📊) due to price hikes in essentials.

This drop in inflation is a welcome relief for consumers, but it also puts the central bank in a tricky spot. With inflation slowing down, there’s a possibility the bank could lower interest rates to stimulate economic activity. But, with some prices still rising, particularly on everyday items, the bank will need to carefully decide how to balance the economy.

Petroleum Sales Surge by 32% in Pakistan as Demand Rises

Petroleum sales in Pakistan rose by 32% year-on-year in April 2025, reaching 1.46 million tons, marking a 20% increase from March 2025. This boost in sales is driven by a surge in demand as economic activity in the country picks up. The rise suggests that more businesses and consumers are relying on fuel, indicating an economic recovery. This trend could lead to more stable fuel prices in the short term, but challenges in meeting rising demand might arise. As the economy continues to recover, petroleum sales are likely to stay strong, with a focus on ensuring a steady supply.

Pakistan's Trade Deficit Widens to $3.4 Billion, Raising Concerns

Pakistan’s trade deficit widened to $3.4 billion in April 2025, driven by a 19% drop in exports and a 14.5% rise in imports. This widening gap signals economic trouble as the country imports much more than it exports, despite receiving significant remittances. If this trend continues, it could put more pressure on Pakistan’s economy, requiring efforts to boost exports and control imports to improve the financial balance.

Govt Raises Rs. 562 Billion Through Auction of Treasury Bills

The government raised Rs. 562 billion by selling short-term debt instruments called Treasury Bills, which it uses to borrow money from investors. This was more than the Rs. 400 billion it initially planned to raise, showing strong investor interest. The interest rates, or the cost of borrowing, remained mostly stable, with a slight increase for the 6-month bills. This is a positive sign, as it means the government is successfully borrowing the money it needs without significantly raising costs for investors.

Get to Know More About Our Products

Behtari – Your all-in-one mutual funds investment App.

StockIntel – Your comprehensive PSX Trading and Analytics Platform.

Data Solutions – Unlock the power of data for smarter, more informed investing decisions.

Wealth Management – Smart wealth solutions for modern investors.

Today’s Pulse by Capital Stake is brought to you by Hubab Irfan