- Pulse by Capital Stake

- Posts

- Stocks Volatile 📉, Oil Recovers 🛢️, Crypto Regulations⚡

Stocks Volatile 📉, Oil Recovers 🛢️, Crypto Regulations⚡

Another Week, Another Pulse

As the world stepped into a new week, markets breathed a sigh of relief after President Trump hit pause on last week’s announced tariffs—for most countries, at least. The move sent oil prices surging by over 4%, giving investors something to cheer about. But that wasn’t the only unexpected headline making waves. In a surprising twist, a Chinese delegation expressed strong interest in setting up donkey farms in Pakistan—a quirky yet potentially lucrative development that piqued investor curiosity. Meanwhile, reports hinting at a possible drop in petrol prices kept everyone on edge, even as gold soared to new highs amid lingering global tensions and tariff war uncertainty.

Here’s your five-minute rundown of the biggest stories in business, finance, and tech. Let’s dive in!

📅 Key Events to Watch This Week!

📌 April 14, 2025

💰 Deposits Distributed by Category of Deposit Holders

📌 April 15, 2025

🏦 Total Investments of Scheduled Banks

💳 Total Deposits of Scheduled Banks

📈 Total Advances of Scheduled Banks

💵 Foreign Currency Deposits

📌 April 16, 2025

📄 T-Bills Auction

⛽ Petrol Price Update

📌 April 17, 2025

🌍 Foreign Exchange Reserves

🏢 Loans to Private Sector Businesses by Type of Finance

📌 April 18, 2025

🛒 Weekly Sensitive Price Index (SPI)

Note: These dates are tentative and subject to change. Credits: Pulse by Capital Stake

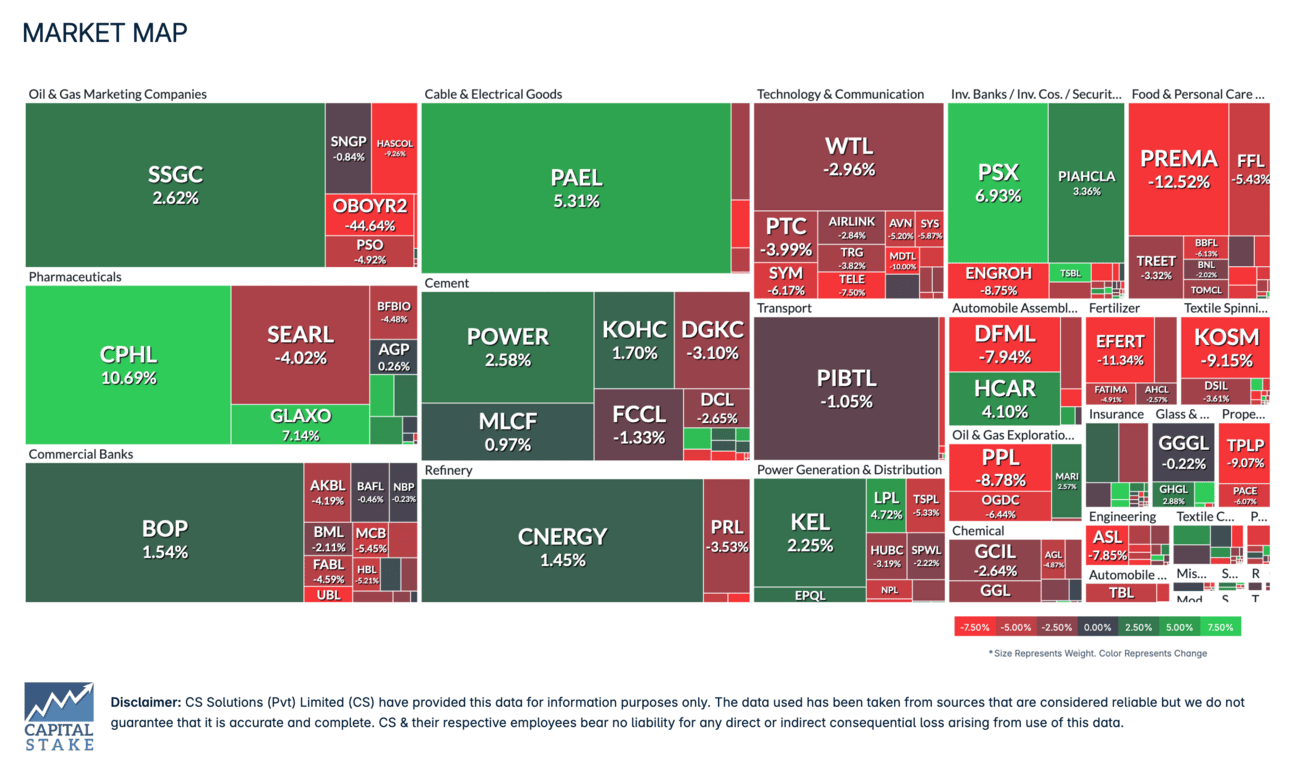

KSE-100 Weekly Performance

The benchmark KSE-100 Index closed the week on a bearish note, dropping by 3.32% on a week-on-week basis. In the final trading session, the index plunged by 1,335.88 points, settling at 114,853.33, reflecting growing investor concerns amid ongoing economic and geopolitical uncertainties.

Tracking your portfolio can be a tedious task—but not with StockIntel. Our portfolio feature lets you trade and track your investments seamlessly, all in one platform. Sign up today and take control of your financial journey!

Govt to Issue Rs. 30 Billion Green Bonds At PSX to Unlock IMF Climate Financing

The Pakistani government is planning to issue green bonds worth Rs. 30 billion on the Pakistan Stock Exchange to raise money for climate-related projects. This move is part of a deal with the International Monetary Fund (IMF) to secure funds aimed at helping Pakistan fight climate change. The money raised will go towards projects that tackle environmental issues, and the IMF will oversee the whole process. The bonds are expected to be issued within the next month.

SPI Records it biggest decline ever

The Sensitive Price Indicator (SPI), which tracks inflation on everyday items, saw its biggest drop ever (See Trend 📊), falling by 2.81% for the week ending April 10. This decline was mainly due to lower prices for onions, wheat flour, tomatoes, electricity, and fuel. It's the lowest SPI on record, showing prices of essential goods have been falling for six weeks straight. While this offers some relief to consumers, it's unclear if this trend will continue in the coming weeks.

Pakistan Eyes Potential Adoption of Digital Currencies

Pakistan has unveiled its first comprehensive policy framework for regulating virtual assets and virtual asset service providers, developed by the National Working Group on VAs/VASPs under the AML/CFT Authority, spearheaded by the FIA. This framework aims to balance technological advancement in digital finance with national security imperatives, aligning with FATF standards to curb risks related to money laundering, terrorism financing, and financial instability while fostering responsible innovation in blockchain-based finance through a gradual and adaptive regulatory approach.

Turkey to Help Explore World’s 4th Largest Oil and Gas Reserves in Pakistan

Pakistan and Turkey have signed an agreement to explore huge untapped oil and gas reserves off Pakistan's coast. The two countries will jointly bid on 40 offshore blocks in the Makran and Indus basins, with Pakistani companies partnering with Turkey’s TPAO. This deal is significant as it could lead to new energy sources, boosting both economies. The next steps will depend on the success of the exploration.

World Bank to Pitch in $300 Million for Reko Diq

The World Bank’s private investment arm, the International Finance Corporation (IFC), is set to provide $300 million in debt financing for Pakistan’s Reko Diq copper-gold mining project. Located in Balochistan, Reko Diq is one of the largest copper and gold deposits in the world. Barrick Gold owns half of the project, while the governments of Pakistan and Balochistan share the other half. Barrick Gold’s CEO, Mark Bristow, highlighted at the Pakistan Minerals Investment Forum that this project will elevate Pakistan into the top ranks of global mining countries. This funding marks a significant milestone for both Pakistan and the company.

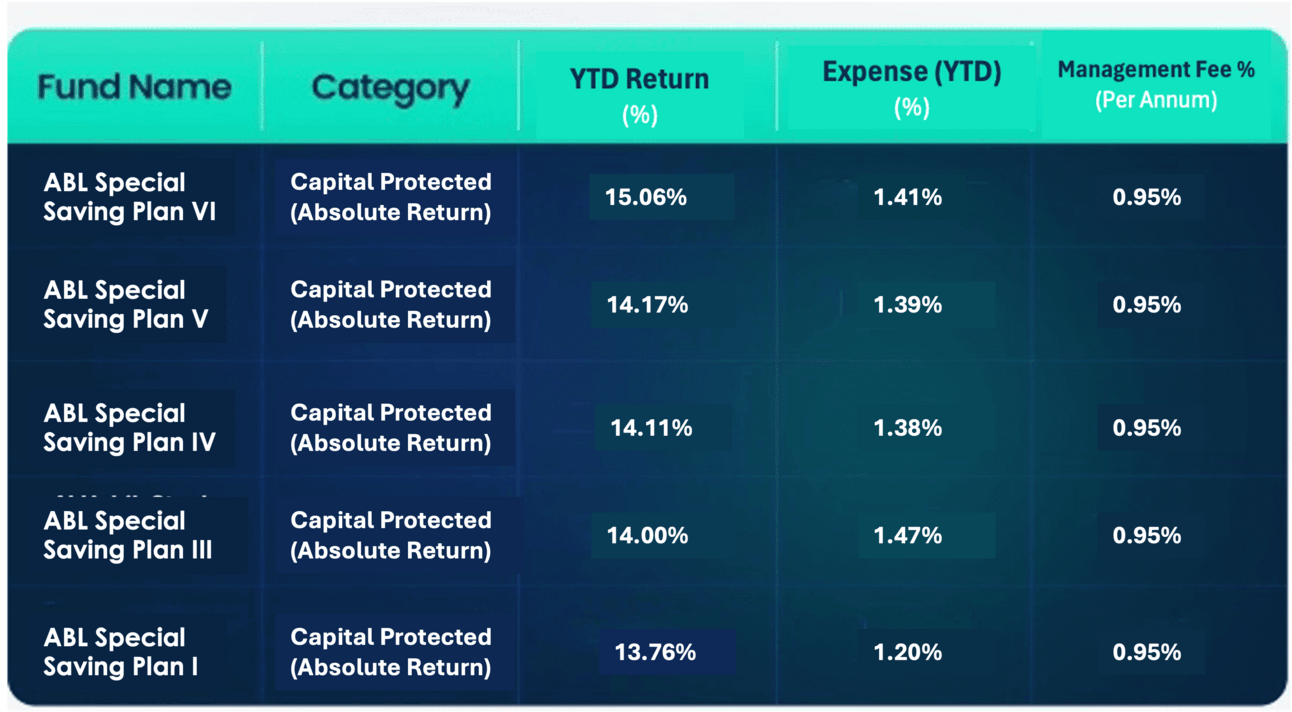

With all the shaky stuff happening in global markets, everyone's looking for safer ways to invest their money. That's where capital protection funds come in – they try to keep your initial investment safe while still giving you a chance to earn something extra. Check out the capital protection funds that have given the best returns over the last three years.

Looking to make the most of your investments? Invest in mutual funds according to your risk appetite with Behtari app📱 today!

📱 Ready to explore these and other mutual funds?

🚀 Start your investment journey with the Behtari app — it’s simple, fast, and built for everyone.

📲 Download now:

🟢 Android: https://shorturl.at/HSNfm

🔵 iOS: https://shorturl.at/J0RUC

Get to Know More About Our Products

Behtari – Your all-in-one mutual funds investment App.

StockIntel – Your comprehensive PSX Trading and Analytics Platform.

Data Solutions – Unlock the power of data for smarter, more informed investing decisions.

Wealth Management – Smart wealth solutions for modern investors.

Today’s Pulse by Capital Stake is brought to you by Hubab Irfan