- Pulse by Capital Stake

- Posts

- 🌍 Tensions, 🧾 Budgets, 📊 Markets

🌍 Tensions, 🧾 Budgets, 📊 Markets

Another Week, Another Pulse!

The outgoing week was nothing short of eventful on both international and national fronts. Geo-political tensions escalated as the Iran-Israel conflict intensified, shaking global markets and sending oil prices climbing. The pressure was felt locally too, with petrol prices in Pakistan expected to rise, as the official announcement is due tomorrow. On the domestic front, the federal budget became the center of attention, sparking widespread discussion across industries and households. Amid all this, the spotlight now shifts to the monetary policy announcement scheduled for today, a decision that could steer the country's economic direction in the days to come.

Here’s your 5-minute recap to plan the week ahead.

Prefer listening instead?

Subscribe to our podcast for the latest business and economic news, anytime, anywhere.

🎧 Listen now on your favorite platform:

Youtube - https://rb.gy/ws1arm

SoundCloud - https://rb.gy/4xtr3x

Spotify- https://rb.gy/x8juim

📅 Key Events to Watch This Week

📆 June 16, 2025

⛽ Petrol Price Announcement

🏦 Monetary Policy Decision

🏛️ Total Advances of Scheduled Banks

💰 Total Deposits of Scheduled Banks

📈 Total Investments of Scheduled Banks

📆 June 18, 2025

🌍 Roshan Digital Account Data Release

📆 June 19, 2025

💵 Foreign Exchange Reserves Update

📉 Current Account Balance

📆 June 20, 2025

🛒 Weekly Sensitive Price Index (SPI)

Note: These dates are tentative and subject to change. Credits: Pulse by Capital Stake

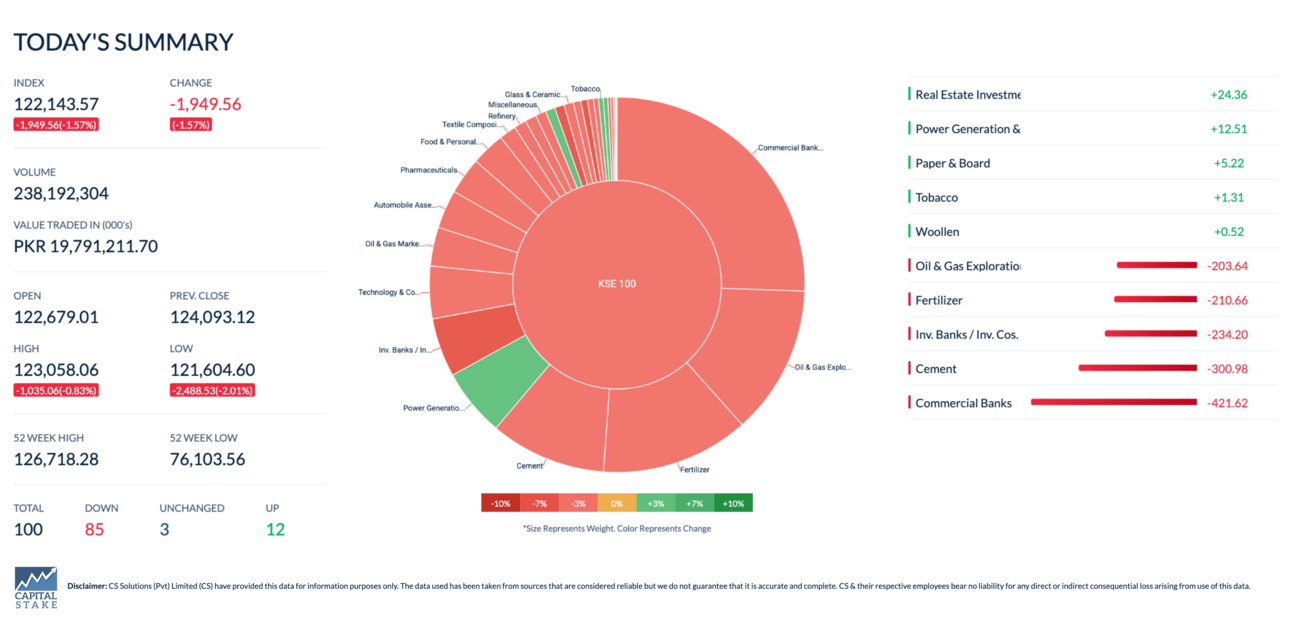

The KSE 100 Index dropped 1,949.56 points (-1.57%) in the last session of the week, dragged down by rising geopolitical tensions following Israeli strikes on Iran and new U.S. steel tariffs. Despite the sharp decline, the index closed the week with a slight gain of 0.10%, supported earlier by relief over unchanged capital gains and dividend tax rates in the FY26 budget.

BCL halts production amid prolonged tractor industry slump

Bolan Castings Limited (BCL), a subsidiary of Millat Tractors (MTL), has halted production due to a continued slowdown in the tractor industry and lack of orders. The suspension highlights the ongoing weakness in agriculture and related manufacturing sectors. Operations will remain on hold until demand recovers, with the company expressing hope for improvement in the near future.

WB approves $700m Reko Diq loan

The World Bank Group has approved a $700 million loan for the Reko Diq mining project, overcoming objections from India, which had attempted to block the financing. The package includes $300 million from the International Finance Corporation (IFC) and $400 million from the International Development Association (IDA). This funding is part of the $3 billion needed to move the project forward. The approval strengthens international backing for one of Pakistan’s largest mineral projects and signals continued progress despite geopolitical tensions. With funding secured, the focus now shifts to advancing development on the ground.

Telco ordered to pay Rs22bn tax on towers’ sale

A major telecom operator has been ordered to pay Rs22 billion in taxes after the Islamabad High Court ruled in favour of the FBR in a case involving the sale of tower assets within its own group. The decision affirms the FBR’s authority to tax gains from intra-group transactions, a move that could impact how future corporate restructurings are structured. The ruling is expected to set a precedent, potentially leading to greater scrutiny of similar deals and increased tax liabilities for companies pursuing internal asset transfers.

Aurangzeb Confirms Eurobond Repayments, Announces Panda Bond Launch

Pakistan is set to make a $500 million Eurobond repayment in September, with another installment due early next year, according to Finance Minister Muhammad Aurangzeb. The government also plans to issue its first Panda Bond later this year and is seeking credit enhancement from ADB and AIIB to support the process. The move signals Pakistan’s efforts to manage external debt responsibly and diversify its funding sources. As credit ratings improve, the government aims to tap Euro and US dollar bond markets by 2026.

Govt to implement Rs77 petroleum levy, Rs5 carbon levy on fuel from July 1, 2025

The government is set to implement a Rs77 per litre petroleum levy and a Rs5 per litre carbon levy on petrol, diesel, and furnace oil starting July 1, 2025, as part of commitments under the IMF’s Resilience and Sustainability Financing (RSF) program. A summary has been submitted to the federal cabinet for urgent approval to ensure inclusion in the Finance Bill 2025-26 before the June 30 deadline. The carbon levy will begin at Rs2.5 per litre in FY26 and double to Rs5 in FY27. These measures aim to meet IMF reform targets and boost revenue through energy-related taxation.

📊 Last Week in Numbers

📈 KSE-100 Index: ▲ +0.10%

🏭 Large Scale Manufacturing (Jul–Mar FY25): ▼ -1.5%

💸 Remittances: ▲ +13.7% YoY

🚗 Auto Sales: ▲ +35% YoY | ▲ +39% MoM

🛒 SPI: ▼ -0.11%

💰 Foreign Exchange Reserves: ▲ +1.45% WoW

Credits: Pulse by Capital Stake

Budget Pulse 2025–26: What’s New, What’s Next

🔒 Fines & Enforcement

📌 ❗ Rs500,000 Fine & 3-Year Jail for Fake CNICs and NTNs

📌 ⚠️ Hiding Income? Prepare for Heavy Fines and Prison Time

📌 👮 FBR Officers Granted SHO-Like Powers for Crackdowns

💰 Salaries, Pensions & Reliefs

📌 📈 10% Salary Hike for Government Employees

📌 🧓 7% Increase in Pensions Approved

📌 🎖️ Special Relief Allowance Announced for Armed Forces

📌 🧑🦽 Conveyance Allowance Increased for Disabled Employees

📌 🪦 Pensions for Spouses of Deceased Employees Now Have Expiry

📌 ❌ Tax Exemption Withdrawn on Higher Pensions

🎓 Education & Income Tax

📌 🧑🏫 Tax Relief Rolled Out for Teachers & Education Sector Staff

📌 👔 Income Tax ‘Relief’ Offered to Salaried Class

🏘️ Property & Real Estate

📌 🏠 Advance Tax Exempted for Existing Property Owners

📌 🧾 Tax Credit Introduced for Houses Up to 10 Marlas

📌 📉 Lower Advance Tax for Filers Buying Property

📌 📈 Higher Advance Tax on Sale or Transfer of Property

📌 🏢 FED Removed on Buying & Transferring Property

🛒 E-Commerce & Digital Economy

📌 💻 Online Retailers Must Collect 18% Sales Tax from Sellers

📌 📦 New Tax Targeting Online Shopping & Cash on Delivery Orders

📈 Investments & Banking

📌 💸 Dividend Tax on Mutual Funds Increased

📌 🧑💼 Super Tax Relief Granted to High-Net-Worth Individuals

📌 💵 Advance Tax on Cash Withdrawals Hiked for Non-Filers

📌 ⚖️ Capital Gains & Dividend Tax Rates Left Unchanged

🚗 Automobiles & Transport

📌 🚘 New Tax Targets Middle-Class Car Buyers

📌 🔋 Hybrid Car Prices to Rise by Over Rs1.4 Million

🌐 Other Key Highlights

📌 ☕ Tea, Coffee, Chocolates & Pet Food to Become Pricier

📌 ☀️ 18% Sales Tax Imposed on Solar Panel Imports

📌 📍 Tax Exemptions Ended for FATA & PATA

📌 💰 Rs17.5 Trillion in Expenditures Planned for FY26

📌 📊 Rs670 Billion in New Taxes Introduced, No Relief for Non-Filers

Credits: Pulse by Capital Stake

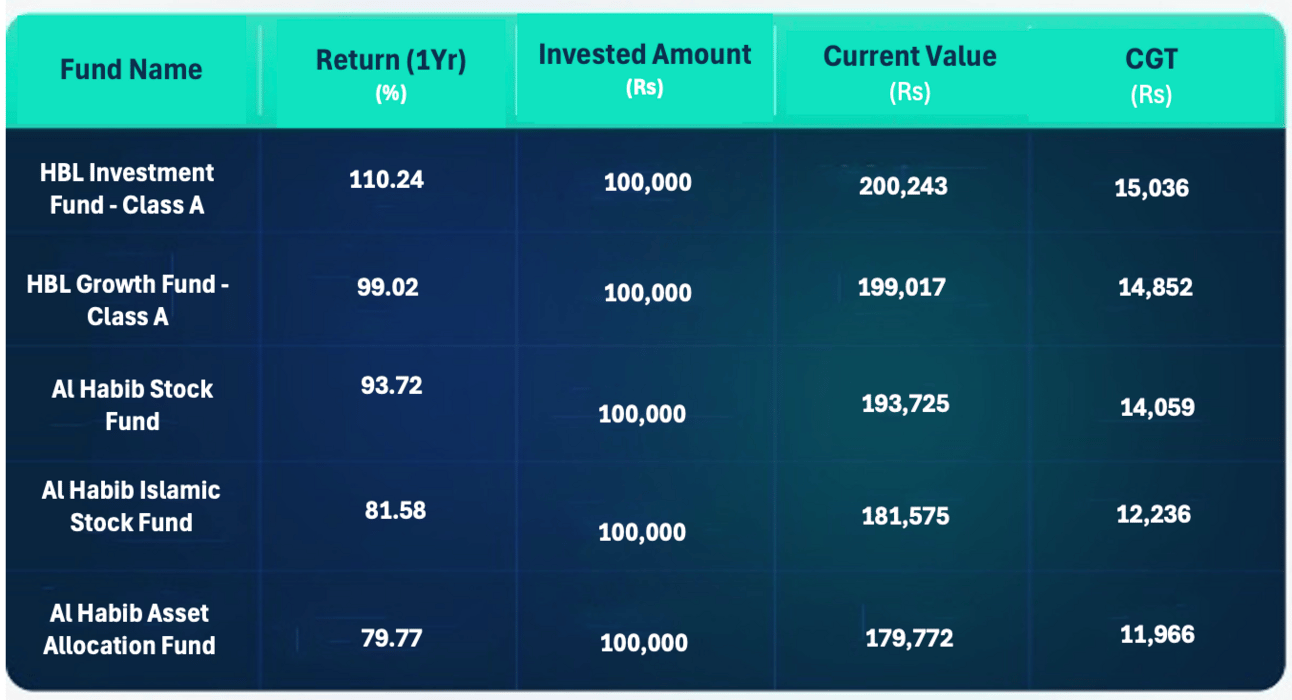

What If You Had Invested Rs. 100,000?

If you had invested just Rs. 100,000 in one of the top-performing equity mutual funds a year ago, here’s how much you could have earned today:

After-Tax Returns?

Even after paying capital gains tax of 15%, your profits remain strong.

With Behtari, you don’t need to be a finance expert to start investing smartly.

🔍 Explore top-performing mutual funds

⏱️ Start investing in under 30 seconds

💼 Diversify with equity, Islamic, and low-risk options

👉 Download the Behtari app today and take your first step toward financial growth.

🍏 IOS Download | 🤖 Android Download

📢 SECP Proposes Key Changes to Voluntary Pension System (VPS) Rules!

Big reforms may be on the way for pension savers. 📑👥

Check out the official proposal here 👇

Get to Know More About Our Products

Behtari – Your all-in-one mutual funds investment App.

StockIntel – Your comprehensive PSX Trading and Analytics Platform.

Data Solutions – Unlock the power of data for smarter, more informed investing decisions.

Wealth Management – Smart wealth solutions for modern investors

Today’s Pulse by Capital Stake is brought to you by Hubab Irfan