- Pulse by Capital Stake

- Posts

- 🌍 Tensions, 📈 Trends, 🌱 Opportunities

🌍 Tensions, 📈 Trends, 🌱 Opportunities

Another Week, Another Pulse!

This week was a whirlwind of events. Tensions escalated, treaties were suspended, and economic forecasts took a hit. The attack in Pahalgam and the suspension of the Indus Water Treaty sparked fresh uncertainty across the region. Adding to the volatility, the IMF lowered Pakistan’s growth forecast from 3% to 2.6% following President Trump’s latest tariff hikes. Amid the turbulence, a rare positive emerged: weekly inflation eased once again, slipping to 3.51%. However, the government expects inflation to remain steady through April before a gradual rise in May 2025.

Catch up on all the latest developments — here’s your 5-minute briefing on the stories reshaping business, finance, and tech.

New Debate in Town!

A recent tweet revealed that Pakistan’s national carrier, PIA, has reported an operating profit for 2024, raising expectations for its privatization. The tweet sparked mixed reactions, with some suggesting the company’s debt was transferred to the holding company, while others argued that PIA’s flight operations have always been profitable. Join the debate on X!

📅 Key Events to Watch This Week!

📌 April 28, 2025

💸 Repatriation of Profit

📌 April 30, 2025

🏦 Quarterly SME Finance Review

📌 May 1, 2025

📈 CPI Inflation Data

⛽ Petrol Price Update

🌍 Foreign Exchange Reserves Report

📌 May 2, 2025

🛒 SPI (Sensitive Price Index) Data

📌 May 4, 2025

🧱 Cement Sales Figures

📌 May 5, 2025

📜 T-Bills Auction Date

Note: These dates are tentative and subject to change. Credits: Pulse by Capital Stake

Barkat Frisian Agro to Invest Rs. 500 Million in Dried Egg Powder Plant

Barkat Frisian Agro Limited (BFAGRO) has announced a Rs. 500 million investment to establish a dried egg powder production facility, with an expected annual capacity of 720 to 1,080 metric tons. The decision, approved by the Board of Directors on April 23, 2025, marks the company’s entry into a new product segment. The plant will be financed through a mix of debt and internal resources, positioning Barkat Frisian Agro to expand its market presence and meet growing demand for value-added egg products.

With the result season in full swing and over 100 board meetings scheduled for next week, catch all the latest updates at a glance on StockIntel. Visit StockIntel’s calendar now.

Week at PSX:

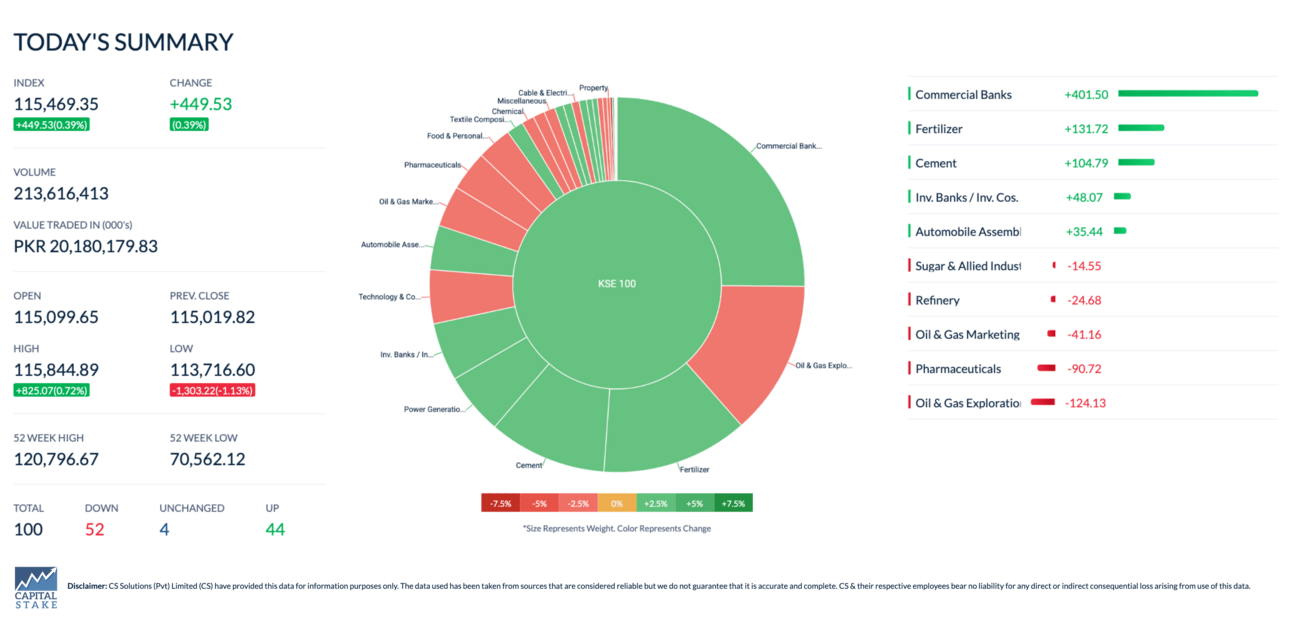

The benchmark KSE 100 index declined by 1.57% on a week-on-week (WoW) basis. However, in the final session, the index gained 449.53 points, managing to overcome selling pressure. Investor sentiment improved after the United Nations called on Pakistan and India to exercise maximum restraint and seek resolution through mutual engagement.

Trump-backed crypto venture partners with Pakistan Crypto Council to boost blockchain adoption

The Pakistan Crypto Council (PCC) has teamed up with World Liberty Financial (WLF), a cryptocurrency platform backed by former U.S. President Donald Trump. This partnership aims to help Pakistan use more blockchain technology and cryptocurrency. Trump’s company owns a large share of WLF, and his support for the industry could lead to easier regulations for crypto in Pakistan. This collaboration could boost Pakistan’s digital economy, attract global investors, and help the country become a bigger player in the crypto world.

Pakistan Asks China to Rollover Outstanding Debt

Pakistan's Finance Minister, Muhammad Aurangzeb, has asked China to extend the deadline for repaying its loans and to increase the amount of money available through a currency swap deal. This deal would help Pakistan boost its foreign exchange reserves from $10.6 billion to over $14 billion in just two months. The request was made during a meeting with China’s Finance Minister at the IMF Spring Meetings in Washington. Aurangzeb also asked China to push back loans from the Export-Import Bank of China until 2027. However, no official decision has been made yet.

SBP Injects Rs11.85 Trillion into Banking System as Foreign Exchange Reserves Drop by $367 Million

To help manage its financial challenges, the State Bank of Pakistan (SBP) has injected a large amount of Rs11.85 trillion into commercial banks for up to 14 days. This is meant to ensure there’s enough money in the system, especially to help the government cover its growing expenses and budget deficit. However, at the same time, Pakistan’s foreign exchange reserves, which are the country's savings in foreign currency, have dropped by $367 million, now standing at $10.2 billion. This decline is mainly due to the country paying off external debts. The government’s increased borrowing and the falling reserves highlight the financial struggles Pakistan faces in balancing its income and spending.

Govt eyes Gwadar for China industry relocation

Pakistan is actively working on a strategy to attract Chinese industries to relocate to the country amid the ongoing trade dispute between China and the United States. Since U.S. President Donald Trump took office, high tariffs have been imposed on Chinese goods as part of efforts to boost American manufacturing. Pakistan sees this trade tension as an opportunity to position itself as an appealing alternative for Chinese companies looking for new manufacturing bases. The government is focusing on Gwadar as a key location for these industries, leveraging its strategic importance and infrastructure development to create a conducive environment for business relocation.

Pakistan to Launch Sovereign Domestic Green Sukuk Next Month

Pakistan’s launch of the Sovereign Domestic Green Sukuk next month is a significant step towards securing climate financing for environmentally friendly energy projects. This initiative highlights the country’s commitment to addressing climate change and promoting sustainable development through innovative financial solutions. By tapping into the green sukuk market, Pakistan aims to attract both domestic and international investors interested in supporting eco-friendly projects. The next step will involve the successful issuance of these sukuks, which could serve as a model for other nations in the region and further strengthen Pakistan’s green economy.

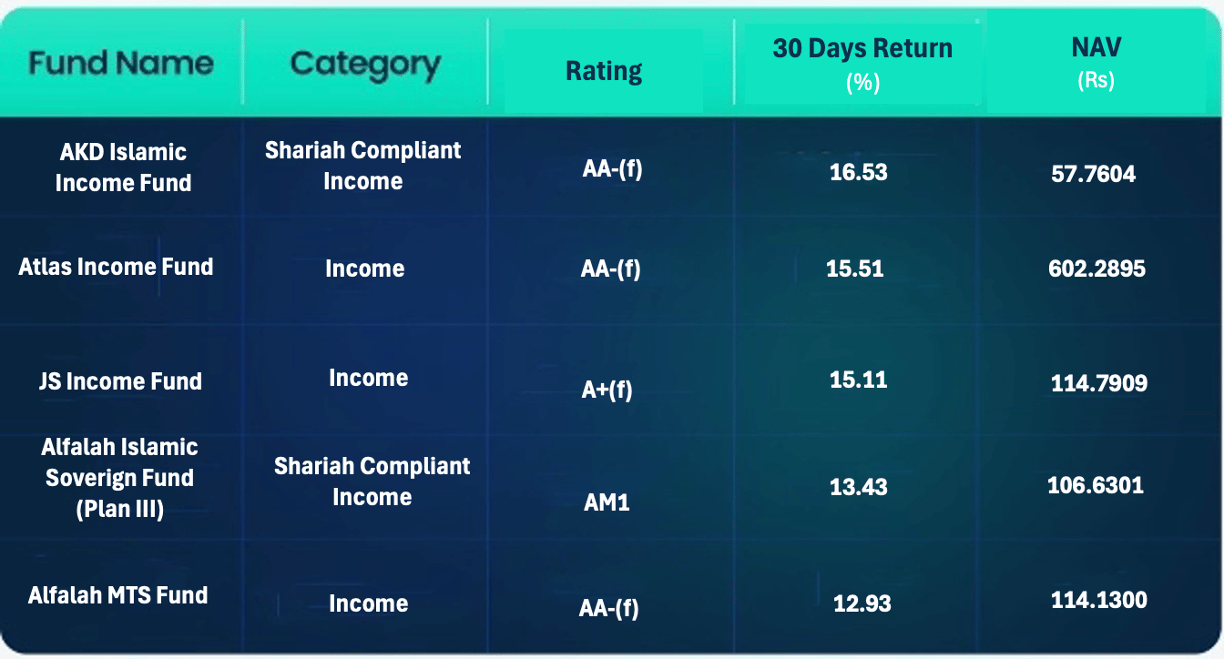

Amidst the fluctuating tides of political and economic events, whether short-term or long-term, income funds offer you the peace of mind you need for your investments. These funds are designed to keep your investment safe, secure, and steady.

Here are the top-performing funds that have declared the highest returns in the last 30 days. Download the Behtari app now to discover more funds that are delivering the best returns and take charge of your financial future.

Credits: Behtari

Source: MUFAP

Behtari is your one-stop solution for mutual fund investments—empowering you to make smarter, more secure financial decisions.

Download Behtari App Now📱 :

Get to Know More About Our Products

Behtari – Your all-in-one mutual funds investment App.

StockIntel – Your comprehensive PSX Trading and Analytics Platform.

Data Solutions – Unlock the power of data for smarter, more informed investing decisions.

Wealth Management – Smart wealth solutions for modern investors.

Today’s Pulse by Capital Stake is brought to you by Hubab Irfan