- Pulse by Capital Stake

- Posts

- 🌍 Trade 💰 Tariffs 📈 Markets

🌍 Trade 💰 Tariffs 📈 Markets

Another Week, Another Pulse!

The new fiscal year kicked off with a flood of economic updates. Inflation for June clocked in at 3.2% YoY moderate by recent standards, but not enough to offset the rising cost of living. Fuel prices saw a sharp hike, with petrol up by Rs8.36 per litre and diesel by Rs10.39. The increase in gas tariffs is also expected to push electricity costs higher by Re1 per unit for gas-powered plants.

On the global stage, oil markets were stirred as a subset of OPEC+ members agreed to ramp up production by 548,000 barrels per day in August—more than expected. Closer to home, there was some financial relief as China rolled over $3.4 billion in loans to Pakistan. However, not all updates were reassuring: air quality in Peshawar reached alarming levels, registering at four times above the safe limit. In another news, tech player Microsoft closed its office in Pakistan and laid off staff, marking a significant exit by a global tech giant.

Here’s your five-minute update on all the news to stay ahead.

🎧 Listen now on your favorite platform:

Youtube - https://tinyurl.com/2s3bufa4

SoundCloud - https://tinyurl.com/5badt97s

Spotify- https://tinyurl.com/vmsnm8mk

📅 Key Events to Watch This Week

📅 9th July 2025

📈 T-Bills Auction

💸 Worker Remittances

📅 10th July 2025

🏦 Foreign Exchange Reserves

📅 11th July 2025

🛍️ Weekly SPI 🚘 Auto Sales

Note: These dates are tentative and subject to change. Credits: Pulse by Capital Stake

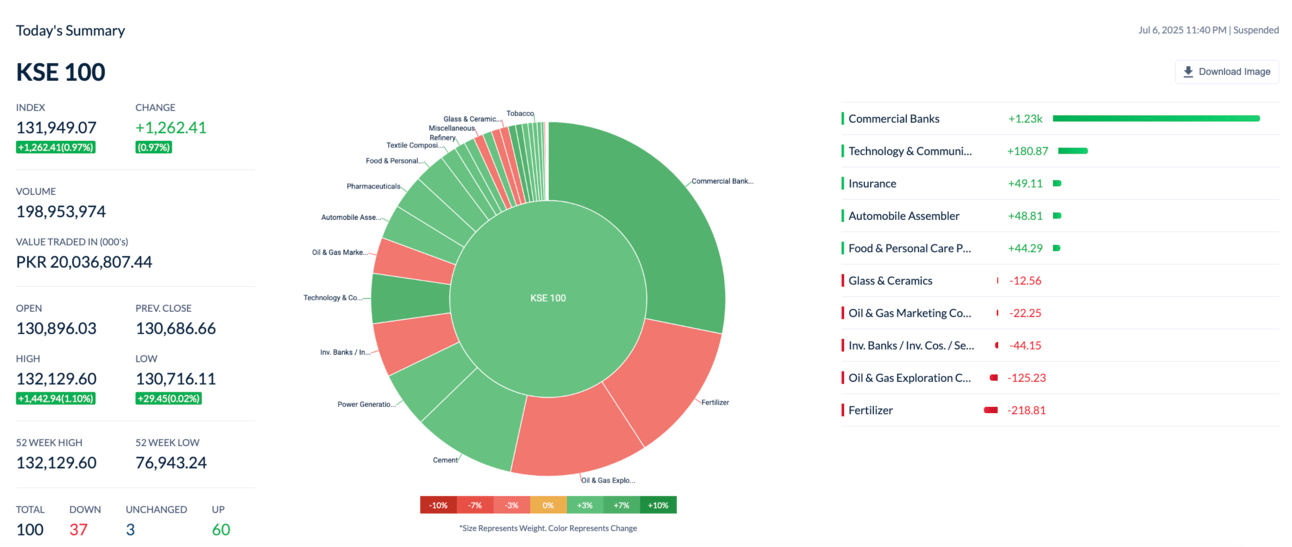

The Pakistan Stock Exchange (PSX) roared into the new fiscal year, with the KSE-100 Index hitting a record high of 131,949.06 points during the week ending July 4, 2025. The index posted a strong gain of 7,570 points or 6.1% WoW powered by improving macroeconomic indicators, renewed foreign inflows, and optimistic investor sentiment.

PIA Investment Ltd Receives $11 Million After 28-Year Legal Battle

After a legal battle that dragged on for 28 years, PIA Investment Ltd has finally received $11 million through an international arbitration award. Federal Defense Minister Khawaja Asif announced the payout, which comes 13 years after the decision was first made in PIA’s favor. While details of the case weren’t shared, this marks a rare financial win for a government-owned company. It’s a small but positive development as the government continues to work on fixing and possibly privatizing PIA.

Prema Milk Fined Rs. 5 Million for Misleading Advertising

Prema Milk has been fined Rs. 5 million for a misleading marketing campaign that claimed other dairy products were unsafe for consumption. The fine follows a ruling by the Competition Appellate Tribunal, which upheld the findings of the Competition Commission of Pakistan. The campaign, launched after a 2016 Supreme Court judgment on milk quality, was found to have no solid basis and harmed competitors' reputations. Although the original penalty was Rs. 35 million, the tribunal reduced the amount, calling it excessive. Prema has also been ordered to issue a public clarification.

IMF Rejects Cheap Power Plan for Crypto and Data Centers

The IMF has rejected Pakistan’s proposal to offer subsidized electricity to crypto mining, data centers, and heavy industries, opposing targeted subsidies despite surplus power in winter. The plan is now under review by the World Bank. Senators also raised concerns over a Rs. 1.275 trillion circular debt deal and ongoing load shedding. The Power Secretary defended the agreement, clarified that no pressure was applied on banks, and shared that over 500,000 users have downloaded the Apna Meter app to address overbilling. He added that 58 percent of electricity consumers currently receive subsidized rates, with Rs. 250 billion in subsidies allocated for the year.

OCAC Warns of Industrial Disruption Over Furnace Oil Price Hike

The Oil Companies Advisory Council has warned that new levies on furnace oil will raise its price by over 80 percent, making it unaffordable for key industries, power producers, and shipping firms. The OCAC said this could lead to shutdowns, collapsed demand, and losses for refineries forced to export. It urged the government to withdraw the levies to avoid harming industrial output and energy stability.

Pakistan, US in Final Talks to Reset Trade Ties

A Pakistani delegation has arrived in Washington to finalise a trade deal aimed at easing tensions over high US tariffs and strengthening economic ties. Pakistan currently faces a 29% tariff on its exports to the US, despite a $3 billion trade surplus last year. To rebalance the relationship, Pakistan has offered to boost imports of US goods such as crude oil and open up investment in sectors like mining. Officials say the talks, expected to conclude this week, may also lead to a longer-term strategic and investment partnership.

This week, we reviewed mutual funds and their management fees. The following funds are charging the highest management fees across the board—and interestingly, they all belong to the same category: equity funds.

HBL Growth Fund – Class B: 3.7%

HBL Investment Fund – Class B: 3.7%

UBL Stock Advantage Fund: 3.5004%

AKD Opportunity Fund: 3.4%

Golden Arrow Stock Fund: 3.4%

While active equity funds often come with higher fees, it’s important for investors to weigh these costs against long-term performance and consider whether the returns justify the price.

👉 Download the Behtari app to explore and filter mutual funds by fee:

📱Android: https://lnkd.in/dhAe2dEz

🍎 iOS: https://lnkd.in/dFQ2Jr3k

Get to Know More About Our Products

Behtari – Your all-in-one mutual funds investment App.

StockIntel – Your comprehensive PSX Trading and Analytics Platform.

Data Solutions – Unlock the power of data for smarter, more informed investing decisions.

Wealth Management – Smart wealth solutions for modern investors

Today’s Pulse by Capital Stake is brought to you by Hubab Irfan