- Pulse by Capital Stake

- Posts

- Trading 📊, Governance 🏛️, Infrastructure 🏗️

Trading 📊, Governance 🏛️, Infrastructure 🏗️

Another Week, Another Pulse!

Winter made its presence felt this week as dense fog rolled into many parts of the country and temperatures continued to fall. But while the weather cooled down, events at home and abroad kept things anything but calm.

Across the border, tensions rose as protests broke out in Iran, with strong warnings coming from its leadership amid fears of possible US action. Global uncertainty like this often pushes investors towards safer options — and that’s exactly what happened as gold prices continued their upward climb.

In the financial world, smaller banks in Pakistan and Japan turned out to be surprise winners, delivering some of the best returns to investors in 2025, helped by strong performance in local stock markets. Back home, United Bank Limited (UBL) made headlines by becoming Pakistan’s largest listed company, with its market value crossing Rs. 1.29 trillion, driven by a sharp rise in its share price.

On the business front, multinational companies operating in Pakistan asked the government for tax relief, urging a cut in the super tax from 10% to 6% in the upcoming budget, and eventually phasing it out. They also raised concerns over delayed tax refunds and what they described as unnecessary pressure from tax authorities.

There were some historic and forward-looking developments too. Pakistan issued its first-ever ferry service licence, a step aimed at boosting tourism and strengthening the “blue economy” — industries linked to the sea. At the same time, construction began on a new container ship for Pakistan National Shipping Corporation, which should reduce reliance on foreign shipping lines.

In telecom news, the government announced base prices for new mobile spectrum auctions, giving operators clarity ahead of next-generation mobile services. Simply put, this helps improve mobile internet capacity in the coming years.

Energy remained a hot topic. The government finalized a plan to reduce gas sector debt without raising gas prices, instead shifting the burden to petroleum users through a possible additional levy on fuel. On electricity, some relief is on the way: revenue from a levy on captive power plants will now be used to lower consumer electricity bills periodically.

On the macroeconomic side, Pakistan requested the UAE to roll over a $3 billion loan, while also meeting another IMF requirement by introducing a system to monitor financial risks in public-private projects. Meanwhile, oil prices rose globally amid uncertainty following dramatic developments in Venezuela.

There was positive momentum in entrepreneurship as well, with over 21,000 new companies registered in just six months, showing growing business activity despite challenges.

Not everything was encouraging though. Short-term inflation ticked up, mainly due to higher prices of everyday essentials like wheat flour, sugar, and rice, a reminder that cost-of-living pressures are still very real.

All in all, it was a week of contrasts: foggy mornings, heated geopolitics, cautious optimism in business, and everyday challenges for consumers. Here’s your five-minute recap of everything you need to know.

🎧 Listen now on your favorite platform:

Youtube - https://tinyurl.com/msm5zvt5

SoundCloud - https://tinyurl.com/4mpaz2r3

📅 Key Events This Week!

📌 15th January 2026

💱 Foreign Exchange Reserves

📌 16th January 2026

🏦 Loans to Private Sector Business

📊 Weekly SPI (Sensitive Price Index)

📌 19th January 2026

💹 Weighted Average Lending and Deposit Rates

💱 Real Effective Exchange Rates

🌏 Foreign Investment in Pakistan

⚖️ Balance of Trade

📤 Export Receipts

📥 Import Payments

Note: These dates are tentative and subject to change. Credits: Pulse by Capital Stake

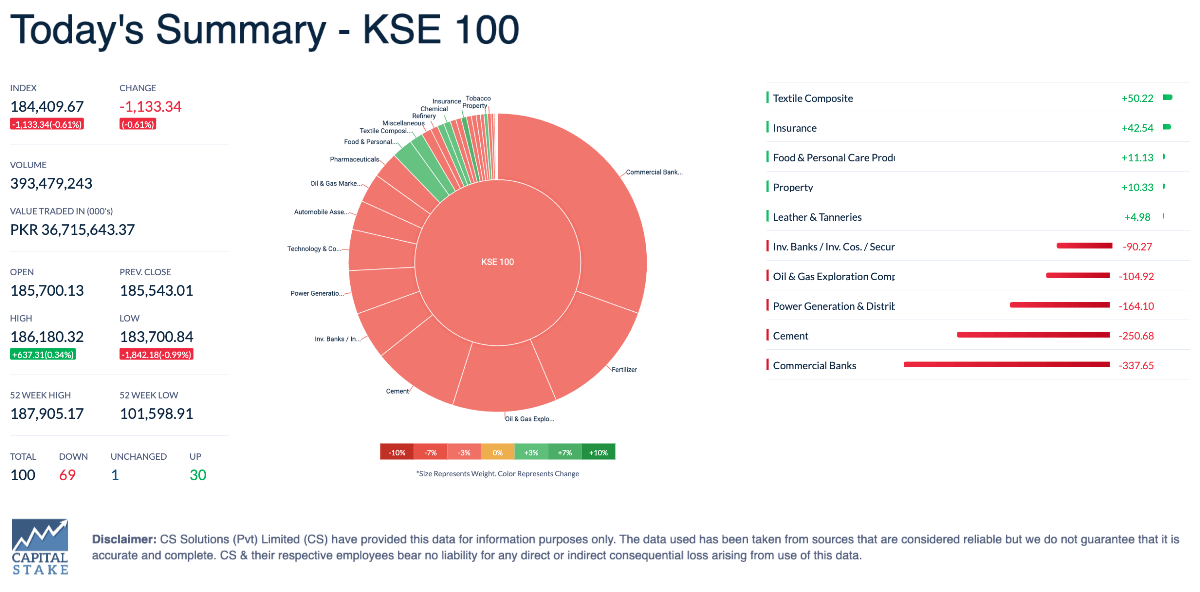

The Pakistan Stock Exchange (PSX) started the year on a positive note, with the KSE-100 Index maintaining its upward trend during the second week. The benchmark index added roughly 5,400 points over the week, posting a 3% gain, and settled at 184,410.

Investor confidence improved on the back of increased activity in key blue-chip stocks, alongside supportive economic signals. Softer yields in the recent treasury bill auction, strong inflows through worker remittances, and encouraging developments from listed companies collectively helped sustain the market’s momentum.

Research Analysts to Require SECP Registration Under New Rules

The SECP has updated its rules for research analysts, now requiring them to register with the regulator, including those who share investment advice on social media. This change is aimed at protecting investors by improving transparency and accountability, ensuring that market opinions are responsible and clearly disclosed. Going forward, all research analysts and individuals providing investment analysis will need to follow the new rules, including a formal code of conduct and stricter disclosure requirements.

Pakistan’s Central Govt Debt Rises to Rs. 77.5 Trillion in November 2025

Pakistan’s central government debt rose slightly to Rs. 77.5 trillion in November 2025, driven mostly by higher domestic borrowing, while external debt fell a little. Despite this monthly increase, total debt has actually declined since June, thanks to lower foreign borrowing, some debt repayments, and a stronger rupee, which reduced the local value of external obligations. Analysts say this shows the government is managing its borrowing more carefully and keeping overall debt under control.

Govt Seeks IMF Nod to Cut Taxes, Electricity Tariffs, Policy Rate in FY27 Budget

The federal government is seeking IMF approval for more flexibility in the FY27 budget, aiming to boost economic growth by reducing taxes, lowering electricity tariffs, and encouraging investment. Officials plan to work with businesses to attract both domestic and foreign investment, focus on export-led growth, and ease the burden on manufacturers by cutting the super tax and raising income thresholds. These steps are part of a broader push to stimulate the economy, create jobs, and reduce poverty.

Govt raises Rs1.08tr through T-bills, bond auctions

The government raised Rs1.08 trillion through auctions of treasury bills and 10-year Pakistan Investment Bonds, with strong investor demand driving bids far above the offered amounts. Yields on T-bills were cut, signaling expectations of a possible policy rate reduction by the State Bank. While domestic debt has risen sharply over the past year, most of the increase came from long-term bonds, helping the government manage repayments and keep short-term borrowing under control.

Is the 2-Year Equity Cycle About to Flip? 🔄

Equity funds ended 2025 with eye-catching returns of 68.24%, building on another strong year in 2024 (80.7%).

A look at the past decade reveals an interesting pattern: hashtag#equity funds often

follow a cycle — two years of gains, followed by two years of declines. This cycle repeated three times over the last 10 years, and now we’re in the midst of the latest recovery.

Will this historic trend continue, or are markets set for another leg up? Either way, it shows why staying invested and watching market cycles closely can make all the difference.

Get to Know More About Our Products

Behtari – Your all-in-one mutual funds investment App.

StockIntel – Your comprehensive PSX Trading and Analytics Platform.

Data Solutions – Unlock the power of data for smarter, more informed investing decisions.

Wealth Management – Smart wealth solutions for modern investors

Today’s Pulse by Capital Stake is brought to you by Hubab Irfan